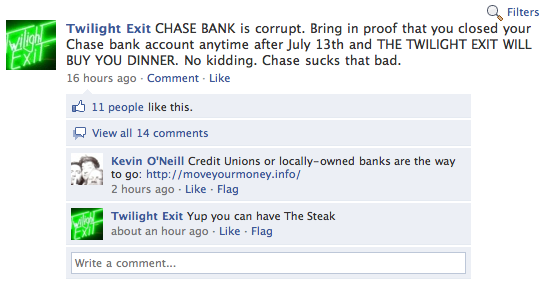

CHS advertiser Twilight Exit has decided it’s had enough of global financial behemoth Chase Bank’s shenanigans. The Capitol Hill expatriate dive bar announced via Facebook that it will buy you dinner if you show proof you’ve quit banking with Chase:

Twilight might think about getting the Bliss Soaps folks involved with the promotion. Bliss claims a Chase error put them in such a financial bind that they could not recover and were forced to close. No word from Twilight about specifics behind this promotion. We’ll ask if they can shed some light on what went down between the Cherry St. bar and the financial giant.

Twilight might think about getting the Bliss Soaps folks involved with the promotion. Bliss claims a Chase error put them in such a financial bind that they could not recover and were forced to close. No word from Twilight about specifics behind this promotion. We’ll ask if they can shed some light on what went down between the Cherry St. bar and the financial giant.

Chase now has a $3 per withdrawal “Additional Withdrawal Fee” for each withdrawal over four per month from your savings account.

For instance, if you have 7 withdrawals in a month, there will be a “Additional Withdrawal Fee” of $9 charged at the end of the month. It can go on for months, until you notice it.

UPDATE: Regarding Regulation D comment following, this is not connected to Regulation D, though Chase cynically tries to confuse the issue by mentioning Regulation D and implying it is related to that. This is their own new way to drain money from savings accounts after 4 savings withdrawals per month of any kind, more restrictive than Regulation D which does not restrict in-person or in-bank withdrawals. It is a spectacularly shameless rip-off, meant to “harvest” cash out of many accounts in a way likely to be unobtrusive.

Right before WAMU imploded, I switched to Wells Fargo (WAMU was my back account from the time I was 15 years old). SO glad I changed – Wells Fargo has been great. Chase is the suck.

Seriously, I left Chase (for the first time) three years ago when I lived in Texas and they started dicking me around. Transferred to WaMu down there, then moved up here shortly afterwards. I was greatly disheartened when Chase took over WaMu, but decided to give them another chance. After a series of issues with them dicking me over and literally having to get the BBB involved to have fees reversed I told them to kick rocks and went to BECU. I hate Chase more than I hate the Utah Jazz and I hate the Utah Jazz a lot!

To hell with them all (banks). Credit Union is definitely the way to go. BECU has super nice employees, and their ATMs are spreading rapidly. We switched from BoA and couldn’t be happier.

Switch because it’s good for you, the world and your community… free dinner is a nice extra incentive though.

Chase has the mortgage on my house. In the process of trying to re-fi my house to a reasonable interest rate Chase has used every trick in the book to stall and/or prevent me from doing so. Too many to go into detail. Chase has had me almost to the point of tears while dealing with them. They seem to think that if they stall I will just go away(kind of like what insurance companies used to/or still do). I won’t go away. I will fight back. I own the Twilight Exit and am using it as my soap box. It’s my only weapon and it’s loaded with free meals. Screw you Chase!

Watermark Credit Union!! BECU is a good credit union but as far as credit unions go they are the most corporate. They have more fee’s and they wont let other credit union members do shared branching (where members of other credit unions can go into a branch of another credit union and initiate transactions – BECU wont let other members of CU’s do transactions at their branches, unless its the main two, but Watermark still allows BECU members to do business at their locations)

I left and I have slowly taken a couple of friends with me. Never again.

I have been wanting to quit chase for a while, but i need some motivation to go in there and close my acct. I saw twilight’s post on facebook yesterday and quit chase today! It feels good! it feels real good!!!

Everyone should consider Express Credit Union as an alternative. It’s the only low income credit union in King County. It’s a great Credit Union and a great way to help out your community! Every service you use at Express helps those who need access to financial services actually get them and help them build assets and achieve financial stability! Check them out at http://www.expresscu.org.

just as bad. finally we officially closed out (after transferring to BECU over a year ago)

Quick note on ATMs: on top of being able to use other CU’s ATMs, seems that CU users can also use ATMs in any 7-11 without fee – even though the ATM might be branded as CitiBank or something else.

This is really handy when travelling; just use google maps or similar to find the nearest 7-11, and presto, free ATM!

We should all just go to the Twilight Exit and buy dinner in support of them so strongly supporting the community. Chase bank is nothing but lies and deceit. You know all of those billboards Chase has around the city about how they support charity and give back to the community? Go in and ask them why they have such high rates on their accounts for nonprofits or why they won’t engage in supporting community growth and development.

Chase is the epitomy of big, bad and ugly and I salute Twilight Exit for taking a stand.

I often take these kinds of things with a grain of salt because, really, most big corporations are pretty sucky when it comes to customer service and how they treat people.

But Chase really does truly suck. I have a credit card with them and they are consistently just the worst to deal with in every way.

Hey twilightexit – can i get a free meal if I cancel a Chase credit card??? :)

Savings accounts by regulation can only have 6 transactions in a 1-month period (in-branch transactions are unlimited). The penalty for going over this amount is nothing new, and all financial institutions have some sort of penalty. It’s called Regulation D. See http://en.wikipedia.org/wiki/Regulation_D_(FRB)

becu foo

when i recently e-mailed to find out what my current apr is on my chase card that i never use (which started out as a bank one card, who was bought by firstusa, who was then bought by chase), i was told that my apr is OVER 19% (!!!) and that it’s based on the prime rate. i responded by pointing out that the prime rate was the lowest that it had been in over 50 years at 3.25%, and asked if by “based on the prime rate” they meant the prime rate plus 15.9%? i didn’t get a response.

I’m glad I closed mine down on the 10th, best of luck to you. They sound like absolute douches.

Hey Chase only does the community giving thing because they are REQUIRED by regulation to do that. It does not come from the goodness of their heart. Good for you TWILIGHT EXIT for highlighting what a miserable institution Chase is. FIRE YOUR BIG BANK!

I agree with the comment below that BECU is a nice big credit union, but if you pick them because of their huge size or their slickness, you are kind of missing the point of why you should switch. Also, the free coop ATM network and shared branching make the number of BECU ATMs irrelevant.

Finally, what Dawn says below is true and is a pretty big scandal. One way BECU got so big is by having only 2 full service branches and all their members can use other credit unions’ branches through the shared branching system. So the little guys pay all the overhead to service BECU’s customers for them. Shady! I went with SMCU.

I just got an email from Amazon offering a $125 gift card if I open a Chase checking account.

Hmmmm. ;)

I’m not going to defend Chase. I’m sure they’re every bit as crappy as many of you say. But people do have a tendency to complain about businesses that merely stick to the terms and conditions that are in place when you sign up for their services. If you’re complaining about these types of actions, then you only have yourself to blame for entering an agreement without thinking about the consequences of it.

Credit unions are nice, but don’t forget that nothing is perfect and there’s always a chance you’ll get screwed no matter where you put your money.

I switched schools this year partly because the PTA had not, to my knowledge, closed its accounts with Chase and switch to a credit union. As a treasurer at the time Chase assumed Washington Mutual’s assets, I received Change of Terms booklets. Where I am, schools’ donation dollars are fewer and have to work harder: getting dinged for depositing auction proceeds because the amounts exceed Chase’s maximum is not how I like my PTA dollars spent.

Move your accounts to smaller community banks or credit unions… Leave Chase and the like.

Saw this story on the late news last night (long after I’d read it here on the CHS blog) and was thrilled to think that there might be a few more people leaving the corporate banks for local credit unions.

There has been a growing movement of people fed up with the big banks who take their money and put it where it does some good.

http://moveyourmoney.info/

They just featured the Twilight Exit on their front page!

Banking with BoA has always been frustrating for me but it’s a hassle to get my auto-pay accounts switched over to a credit union. If there’s an easy way to do it, I’m all for it!

I love BECU! I’ve had accounts with them for a couple of years, and the only time I had to use shared branching was at WSECU to use their coin machine (free for credit union members!). I like their concept of neighborhood centers with a couple of atms and a couple of customer service reps – it takes up way less space than a traditional branch. It is kind of corporate for a credit union but I like that they have branches all over town when I need them.

I went through the same thing with a loan modification that they delayed it for almost a year and then declined me. They took me for $4,000 and then wanted me to be be delinquent. When I refused to do that they declined me again. What a f*** waste of time and money. Now they wont give me my money back because I will not go through the modification process for a third time. They say that I withdrew the process. Chase Sucks

Really, HP, is it important WHAT Chase may have done to piss off Twilight Exit bar? I don’t think so. I mean, come on… we’re talking about Chase Bank. It could be any one of a million predatory things that they routinely do. The only important thing here is that someone is doing something positive to encourage Chase customers to come to their senses and quit the bank.

If I had a restaurant I’d make the same offer to B of A customers.

Yeah, yeah… these perks are only lipstick on the pig. Look past the lipstick folks, and you’ll see the pig smirking at you. You get NOTHING for free from a bank. Chase undoubtedly is betting that if you take the Amazon gift card that they’ll trip you up and get way more than that $125 out of you.

As for Terms and Conditions… that’s what my PROC-7 plan is about. PROC-7 limits the T&C’s so that the bank’s greedy hands are tied. It tells the banks that we consumers are sick and tired of the way they disrespect us when it’s OUR money they are using. When you leave your big bank, give them a copy of PROC-7 to mull over. If enough people do this, the banks will eventually have to change their current nickel-and-dime policies in order to win back customers.

By accepting that Amazon card you become an enabler, you accept a deal with the devil, and you undo all the good that organizations such as Move Your Money are doing to reform banks from the consumer level. DON’T TAKE THE BAIT!

More on PROC-7 at http://wedemandchangenow.blogspot.com/

Even if this business owner were not having trouble with their Chase Bank loan department, why would a thinking person want to continue doing business with them? Chase has a reputation, and I can’t think of anything I’ve heard good about it!

I wasn’t actually considering opening an account. Just being facetious about the “deal” I was offered in light of this article.

They don’t charge you for in-person withdrawals, as they don’t count towards the Regulation D limits. Different accounts with Chase have different limits for withdrawals. If you’re withdrawing that often from your savings account, you should have a checking account instead. They have about the same interest rate right now, anyway.

The shared branching thing about BECU isn’t exactly true… The shared branch network administrators won’t ALLOW them to facilitate other people’s deposits in their branches because they don’t have cash or teller services, and can’t give a physical receipt for cash accepted. All shared branching and co-op network folks can use their ATM’s for deposits at no charge. The only reason they couldn’t accept a deposit is if the person making the deposit really wanted to make a deposit with a person for some reason.