UPDATE: The results are in. We hope you’ll consider the endorsements from your most active CHS peers as you dig through the November ballot. Happy voting.

Original Post: King County ballots will be in the mail headed to Capitol Hill starting Wednesday. Below, we present the CHS November 2010 election community endorsement process. Users with registered accounts may vote in any or all of the polls below to shape a list of CHS community endorsements. King County’s online voter pamphlet can be found here. If you have suggestions for voter guides or more to say about a particular candidate or issue, please share in comments.

- Registered CHS accounts may vote in each poll once

- Polls close Friday night at 9 PM Capitol Hill Standard Time

- If you do not have an account, you may create one here

- Log in here

- If you do not wish to have an account, you can have your say in the comments

- There are no error messages, by the way, if you try to vote without being logged into an account. So if you think you are voting without an account, you are not. You are clicking on a link that does nothing.

- The CHS Endorsements and final results will be published over the weekend. In the meantime, if you’ve voted, you *should* be able to see the poll results when you return to page without clicking “Show Results.” If you haven’t voted, you’ll need to click the “show” link. It’s a drag, I know. We’ll give you a good way to view once the results are in Friday night.

- Unlike some endorsement processes, the top vote getter does not need to achieve a certain percentage.

- Want to say something about your favorite candidate or cause or add a voter guide for people to consider? Add a comment below

FEDERAL

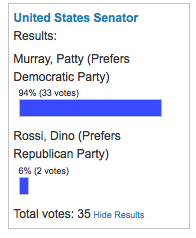

United States Senator

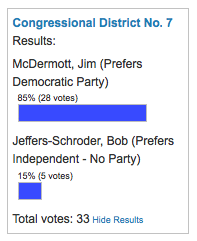

United States Representative

STATE

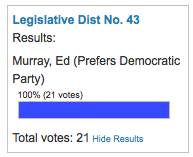

State Senator

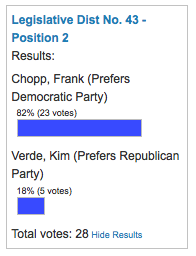

State Representative

State Representative

COUNTY

CITY

Seattle Municipal Court

Note: uncontested municipal and state judge positions are not included

MEASURES

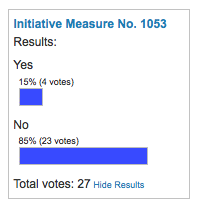

Initiative Measure No. 1053

This measure would restate existing statutory requirements that legislative actions raising taxes must be approved by two-thirds legislative majorities or receive voter approval, and that new or increased fees require majority legislative approval.

Initiative Measure No. 1082

This measure would authorize employers to purchase private industrial insurance beginning July 1, 2012; direct the legislature to enact conforming legislation by March 1, 2012; and eliminate the worker-paid share of medical-benefit premiums.

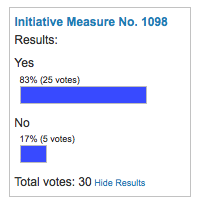

Initiative Measure No. 1098

This measure would tax “adjusted gross income” above $200,000 (individuals) and $400,000 (joint-filers), reduce state property tax levies, reduce certain business and occupation taxes, and direct any increased revenues to education and health.

Initiative Measure No. 1100

This measure would close state liquor stores; authorize sale, distribution, and importation of spirits by private parties; and repeal certain requirements that govern the business operations of beer and wine distributers and producers.

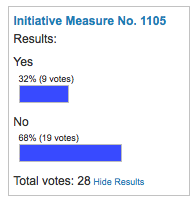

Initiative Measure No. 1105

This measure would close all state liquor stores and license private parties to sell or distribute spirits. It would revise laws concerning regulation, taxation and government revenues from distribution and sale of spirits.

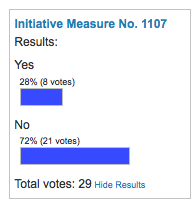

Initiative Measure No. 1107

This measure would end sales tax on candy; end temporary sales tax on some bottled water; end temporary excise taxes on carbonated beverages; and reduce tax rates for certain food processors.

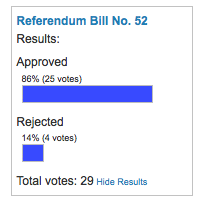

Referendum Bill No. 52

This bill would authorize bonds to finance construction and repair projects increasing energy efficiency in public schools and higher education buildings, and continue the sales tax on bottled water otherwise expiring in 2013.

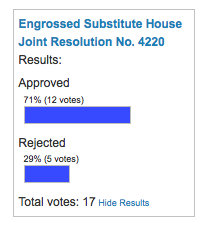

Amendment to the State Constitution

This amendment would require the state to reduce the interest accounted for in calculating the constitutional debt limit, by the amount of federal payments scheduled to be received to offset that interest.

Amendment to the State Constitution

This amendment would authorize courts to deny bail for offenses punishable by the possibility of life in prison, on clear and convincing evidence of a propensity for violence that would likely endanger persons.

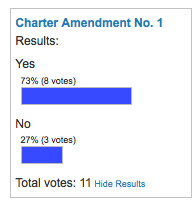

Amendments to the Preamble

Shall the preamble of the King County Charter be amended to specify the local and regional role of county government and clarify the purposes of county government, as provided in Ordinance No. 16884?

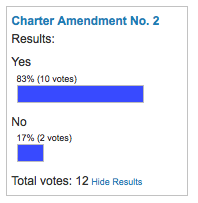

Amendment of Section 690 – Campaign Finance

Shall Section 690 of the King County Charter be amended to specify that timely filing of a statement of campaign receipts and expenditures with the Washington State Public Disclosure Commission in accordance with chapter 42.17 RCW satisfies the filing obligations of Section 690 of the King County Charter, as provided in Ordinance No. 16885?

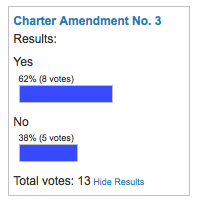

Amendment of Section 890 and New Section 897 – Collective Bargaining

Shall the King County Charter be amended to allow the King County Sheriff to serve as the county’s collective bargaining agent for all department of public safety issues except for compensation and benefits, which would continue to be bargained by the county executive, as provided in Ordinance No. 16900?

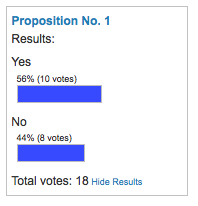

Sales and Use Tax for Criminal Justice, Fire Protection, and Other Government Purposes

The Metropolitan King County Council adopted Ordinance 16899 concerning funding for criminal justice, fire protection, and other government purposes. This proposition would authorize King County to fix and impose an additional sales and use tax of 0.2%, spilt between the county (60%) and cities (40%). At least one-third of all proceeds shall be used for criminal justice or fire protection purposes. County proceeds shall be used for criminal justice purposes, such as police protection, and the replacement of capital facilities for juvenile justice. The duration of the additional sales and use tax will be as provided in section 6 of Ordinance 16899. Should this proposition be:

Seattle School District No. 1

Supplemental Operations Levy

The Board of Directors of Seattle School District No. 1 passed Resolution No. 2009/10-15 concerning this proposition for supplemental educational program funding. To partially replace reduced State funding and to improve education throughout Seattle Public Schools this proposition authorizes the District to levy the following supplemental taxes on all taxable property within the District, to help the District meet the educational needs of its approximately 45,507 students. Should this proposition be approved?

Dino Rossi is a political zero, by any standard.

Ms. Murray is far from perfect, but, she makes him look like the nobody he is.

I think his base is far right and there are hints of corruption as well.

Vote patty Murray.

K-12 Education (City of Seattle Prop 1) and services for victims of violent crime (King County Prop 1) are both worthy of our tax dollars. Vote yes on both!

Vote yes on both liquor amendments. We need to send a message to olympia that prohibition is over and that their monopoly is bullshit.

The arguments of ‘wont someone please think of the children’ and ‘b-but the little guys’ are also complete bullshit. They benefit from the monopoly that restricts our freedom. Fuck them. Play in the big leagues or get out of the game.

Lets get into the 21st century, Seattle.

How about the argument that the state can’t afford to lose over 5 million dollars in the current economic climate of slashed budgets and services? The government is not “them.” It is “us”. The services that are provided by the state – from education to roads, insurance for those who can’t afford it to unemployment for those who have lost their jobs – these things all benefit US. Shutting down state liquor stores will mean more layoffs and less services for our state. If it’s more important for you to be able to get a bottle of liquor after 9pm, than it is for your neighbor to have health care, than I guess so be it.

(1.) The State will actually make more money from increased availability and sales.

(2.) The State will also save money by not paying for State liquor store leases, employees, benefits, and pensions.

(3.) And, the Liquor Control Board will CONTINUE to be in the business of enforcement and protecting minors from buying alcohol.

Sounds like a win-win.

I’d be more than happy to cancel out your vote.

If you are truly concerned about corruption, you have an issue with Murray as well.

Rossi is a zero on LGBT rights.

Among many other issues.

In FY 2010, the WSLCB had a net profit of $360 million, which went to the state general fund and to local governments as well. According to the absolute best case estimates, under 1100 the state will lose about $15-17 million per year.

Cheap booze is not worth that price.

Raise the tax on booze — much much easier than keeping the retail game.

Old and obsolete. Why should I drive all over town to buy a bottle of rum for baking?

Or, drinking?

Tax reform, no more shell games for state revenue.

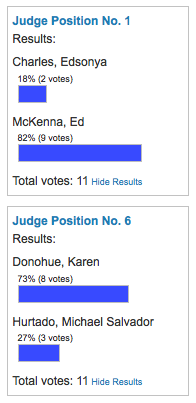

endorsed by Charles Royer and Joe Mcdermott? Tough as nails and dedicated to fairness, willing to risk not being liked by lawyers that appear before her bench…

…As opposed to Ed ‘endorsed by Mark Sidran/SPD guild/business associations’ McKenna? He’s actually a good prosecutor: let’s not lose him in this capacity!

Why is everyone willing to give the legislature free power to institute legislation without a 2/3rds majority?!?! Are you quite dumb enough to let lawmakers start a new tax anytime they want?! Please, if you don’t understand the legalese please take your hipster self out of the election process.

Yes

16% (4 votes)

x

No

84% (21 votes)

x

Total votes: 25 Hide Results

Initiative Measure No. 1053

This measure would RESTATE existing statutory requirements that legislative actions raising taxes MUST BE APPROVED by two-thirds legislative majorities or receive VOTER approval, and that new or increased fees require NAJORITY legislative approval.

Obviously the Caphill scene has no clue what they are voting on nor are the neighborhood voters versed in the future implications of starting the I-1098 income tax.

Initiative Measure No. 1107

This measure would end sales tax on candy; end temporary sales tax on some bottled water; end temporary excise taxes on carbonated beverages; and reduce tax rates for certain food processors.

Initiative Measure No. 1107

Results:

Yes

30% (8 votes)

x

No

70% (19 votes)

x

Total votes: 27 Hide Results

Initiative Measure No. 1098

This measure would tax “adjusted gross income” above $200,000 (individuals) and $400,000 (joint-filers), reduce state property tax levies, reduce certain business and occupation taxes, and direct any increased revenues to education and health.

Initiative Measure No. 1098

Results:

Yes

85% (23 votes)

x

No

15% (4 votes)

x

Total votes: 27 Hide Results

YES, well versed. About time for tax reform and that means an income tax and lowering the sales tax.

We know EXACTLY why we are voting yes …. about damned time for reform efforts to to pass at the ballot box.

( pic, James Dean and Sal Mineo – 1950ies, late or early 60ies…)

Wish this were the real ballot — I’m in the majority on every one of these (at least the ones I voted on — haven’t figured out all the judicial races yet). Capitol Hill ought to be a state all by itself.

Seriously, I hope everyone at least votes for Patty Murray, Yes on 1098, and No on 1053 and 1107. Everything else is secondary (or moot, in the case of Chopp and McDermott). Many of us are going to find ourselves more dependent on goverment in the next few years than we ever imagined we would be, and solidifying our revenue structure with a high-end income tax and enhanced legislative taxing power is a matter of self-preservation. Mark my words.

Hey – very WELL versed.

Some of us leftist Dems. may have problems with some of the well know Dem. names at times – but – take a look at the Republican Party in this state….. simply beyond horrid.

Remember they have opposed LGBT rights for over thirty years, all issues, every step of the way, including Ref: 7, just a party amazingly out of touch and homophobic.

And witchcraft was a big deal in their platform a few years back, yes, Craswell era.

Their voice is NOT needed in any policy I can think of, oh, wait, cutting back money for food banks, ending helping the unemployed with subistance, and more tax loopholes…..

@mikewithcurls

I guess that makes me log cabin republican although I can’t stand both Murray AND Rossi. But what does that have to with the absurd and complicated “flour” tax? Just more complicated tax laws on the books. Also, starting an income tax will slowly trickle down to the rest. I seriously doubt CapHill hipsters will be thankful for new taxes and that extra tax doesn’t mean the money will immediately go to good use rebuilding and polishing the slum streets of CapHill – it will just be a larger funnel diverting to the politicians pockets.

CapHill has a large GLBT community wanting equal rights, but at the same time are providing no mercy to suppress the rights of open commerce with this liquor monopoly and unequal flour tax!

I think the candy bar tax is stupid and does not represent tax reform but just another are you kidding me tax.

And, more importantly, I think candy is food by the nature of its ingredients and the use our bodies make of it. Thus, it is an illegal tax. Liquor will be privitized, simple matter of ease of purchase for retail buyers. State can raise the tax to compensate for revenue loss.

But, Rossi is still a zero.

(pic, Dr. King and his close associate who helped on major organizing, Bayard Rustin. Rustin was an avowed homosexual, once jailed for that. He has never been fully acknowledged for his massive organizing efforts in the Civil Rights movement.)

I can’t believe anybody would be stupid enough to vote no for I1100. If you bother to pull your heads out of your butts and read the FACTS, not the scare tactics from the State, you’ll see the State will most likely SAVE money. There will be NO difference in drunken driving accidents. If anything, there will be fewer because people can stagger to their local Safeway for a bottle instead of driving to one of the few liquor stores we have now.

Stupider still would be a yes vote on a personal income tax measure. TWO YEARS, people, that’s all it will take to extend that to everyone. Furthermore, it will create an entire state division to administer the reporting. EVERYONE will have to report.

Chris, you must be stupid to think that income tax is going to remain ONLY on those in a higher income bracket. EVERY tax the state has been authorized to collect for a specific purpose has been repurposed in 2 to 4 years and expanded.

Damn, there’s a lot of stupid people around here

Abbot, that’s bullshit and you know it. Check out the REAL facts, not the ones put out there by the union representing the retail store clerks. The state will at worst be revenue neutral and at best saving money if 1100 passes.

I 1100 leaves the current volume tax in place. Being sold in a retail grocery store would subject the purchase to state sales tax. That’s all built in to the price you pay at the liquor store. The only thing that markup is paying for is the overpaid retail liquor store staff.

HINTS of corruption, Mike? Helen Keller can see the man is one of the most corrupt and crooked things to run for office in this state!

The man is slime.

There is no stipulation in Initiative 1098 about lowering the sales tax…it has been rising steadily for years, and there is no possibility of it going down. I am in favor of a state income tax that would apply to everyone, with progressive rates so that the rich would pay a significantly higher percentage.

An income tax only for the wealthy is basically unfair and probably unconstitutional. I’m voting no on 1098.

I’m gonna quote the Stranger here for YOUR hipster selves: “The poor pay 17.3 percent of their income in taxes, while the rich pay only 2.6 percent of their income in taxes. Say it with us: That is NOT. FUCKING. FAIR.”

Our tax system is one of the most regressive in the nation and 1098 is simply taking steps to even things out. Which brings me to another point…

I am voting NO on Eyman’s 1053 because I don’t trust my fellow humans to understand the ins and outs of our public policy. People seem to think that the services we enjoy come out of the thin air. Just so we’re clear: they don’t. They’re payed for by our tax dollars. The roads you drive on, the folks that help you out when your house is burning down, the people who make sure that the food restaurants serve you is safe to eat. Are you an expert on how much this stuff costs and the best way to implement these things? No, you’re not. And neither am I. So let’s leave that stuff to the people who know what they’re doing.

Jane,

You won’t trust your fellow humans but you will trust elected officials who are also human. Maybe you are more dumb than the rest of us.

Yes, the wealthy pay a smaller percentage of their income in taxes, although I’m not so sure the Stranger’s figures are accurate…I’m sure that some wealthy people pay more than 2.6%.

But the figures are misleading, because the wealthy do pay ALOT more than others in absolute dollars, and they contribute the majority of total taxes to the IRS, and also to state/local coffers. A quick example: 17.6% on a $30,000/year income is $2280, but 2.6% on a $300,000/year income is $7800.

Initiative 1098 is a “soak the rich” (class warfare) scheme, pure and simple. By the way, I’m not wealthy.

Originally I thought, ‘good idea’. Now I am thinking about Habeas Corpus, and how eager Bush and friends were to go after it. Any lawyers out there with an opinion on this aspect?

FYI: the amendment:

Amendment to the State Constitution

This amendment would authorize courts to deny bail for offenses punishable by the possibility of life in prison, on clear and convincing evidence of a propensity for violence that would likely endanger persons.

Tom writes:

“Chris, you must be stupid to think that income tax is going to remain ONLY on those in a higher income bracket. EVERY tax the state has been authorized to collect for a specific purpose has been repurposed in 2 to 4 years and expanded.”

I’m well aware of this possibility, Tom, and frankly, I’m fine with it. In fact, I support it, for the reasons I gave in my original post.